Call Or Text Us Anytime 813–543-8346

Hi. This is Tom Leber with Homeward Real Estate’s Full Sale Team and this is a run down of the 2022 Year End market data for the Heights and Central Tampa neighborhoods, and what we might expect in 2023.

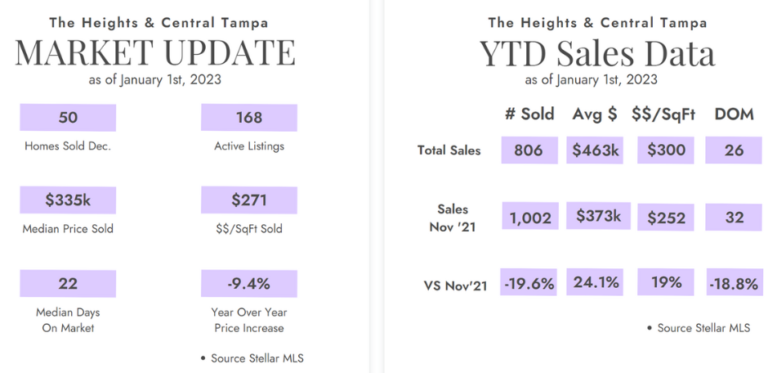

We can all agree that most of 2022 was a crazy year for real estate in our community! Home prices appreciated over 20% year over year in most neighborhoods. The median home price sold last month was $335k compared to $428k for the Tampa Metro area. Homes in Central Tampa sold at a price point of $271/sqft.

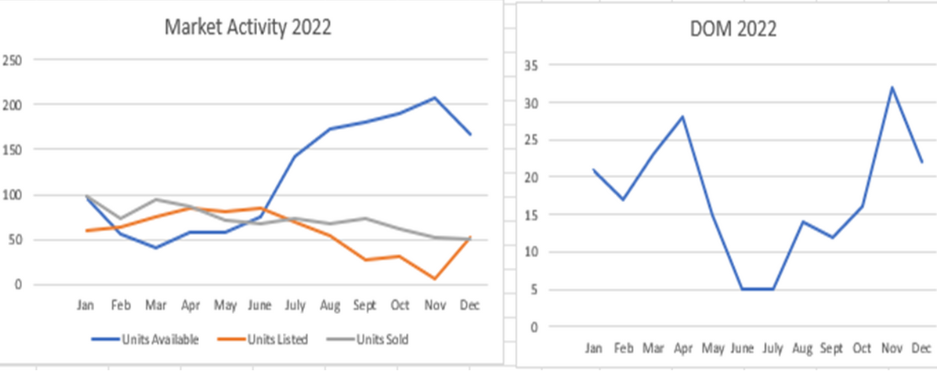

This was significantly lower than prior months and it took a bit of digging to try to understand what happened to housing prices in the 3rd quarter. As this line graph shows there was very little inventory available at the beginning of the year. The number of homes listed and sold started to taper off around July from around 100 homes a month to about 50 homes. Note that the number of homes sold equates over time to right around the same number listed, but the excess inventory is now slower to move. Days on market is back just under the 30 day mark which is still fairly low for a normal market.

So what is causing this recent slow down in the market? Well, there are two obvious factors that I can see. First, 2022 was probably the 1st time in 2 years that parents sent their kids back to school full time. During the pandemic shut down it was actually easier to sell and move kids while they were home schooled.

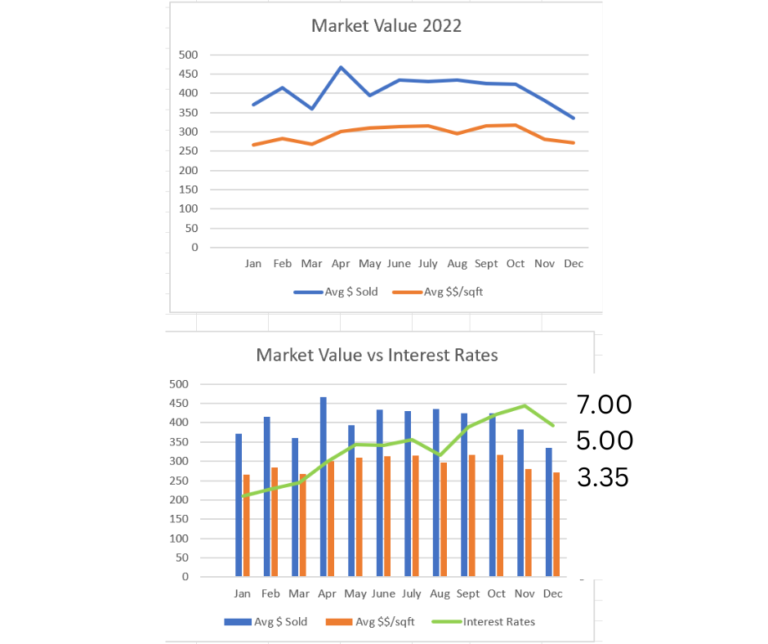

The other elephant in the room is the mortgage interest rate moving from the mid 3% to around 7%. This had an enormous effect on bottom line monthly payments most people could afford, and basically what they could get for the price of financing.

Note that at the beginning of the interest rate increase the average dollar per square foot stayed pretty flat. When interest rates were between 3-5%, throughout most of the summer, it seemed to have little impact on home sales. Once the rate spiked to 7% in November, it had a notable impact to sales volume and price.

Has anybody noticed the drop in interest rates since then? Lenders set rates by supply and demand, just as homeowners set prices based upon those same factors. It will be interesting to see if mortgage rates continue to climb in early 2023, or if this is an indicator of the ceiling.

So what does this all mean for 2023? Let me start by saying that I am not an economist, nor a fortune teller. What I can say, is that unlike 2008 the economy is stronger, there is much less unemployment, there is much less housing inventory, and inflation seems to be leveling off. Home prices also seem to be leveling off as compared to the 20-25% appreciation rates we saw over the last two years.

There is still only a little over 3 months of inventory available in this market. Remember that 5-6 months of inventory is a neutral market and anything less is still a seller’s market.

So in short, I am anticipating the housing market activity to return to somewhat normal, pre-pandemic levels and price appreciation over the next year. I do anticipate that the typical seasonal sales cycle will begin to return, with an increased pace of listings in the spring and a steady level of sales over the summer.

If you would like to see a report breaking down specific data for your neighborhood, click on the Market Reports button below. There you will find the real estate statistics for your specific neighborhood in Central Tampa.

If you have any questions about the information you receive, or if you have any questions about real estate in our community, please feel free to reach out to me directly at 813-543-8346, or sign up for a FREE valuation generated specifically for your home.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

SEMINOLE HEIGHTS LIVING

Home Values In Your Neighborhood Have Changed.

See What Your Home Is Worth Today!

Seminole Heights Living