Call Or Text Us Anytime 813–543-8346

Hi! This is Tom Leber with the Homeward Real Estate Full Sale Team bringing you the news about real estate activity and values in the Heights and Central Tampa community!

Well we just got January’s numbers in and there are some surprising things happening in the market today that you should be aware of.

The 30 year fixed mortgage rates have a corollary association with the Federal borrowing rate. This means that they are not specifically tied to one another, but when the Fed rate rises, the cost money increases which will usually influence mortgage rates.

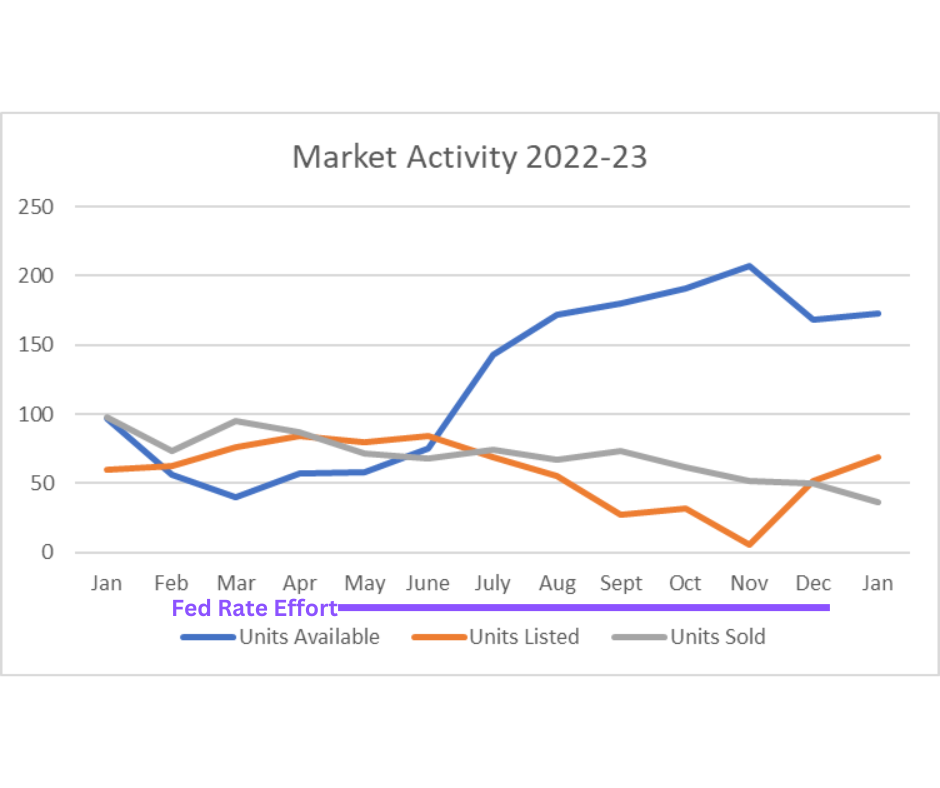

It is apparent that the steps taken to reduce inflation, by increasing the Federal borrowing rate (in purple), did influence mortgage rates, and thus has carried over into the real estate market activity by slowing the purchase of homes over the last 7 months.

This chart reflects that once rates started to significantly increase in May of 2022, there were fewer people listing their homes and home sales started to taper off.

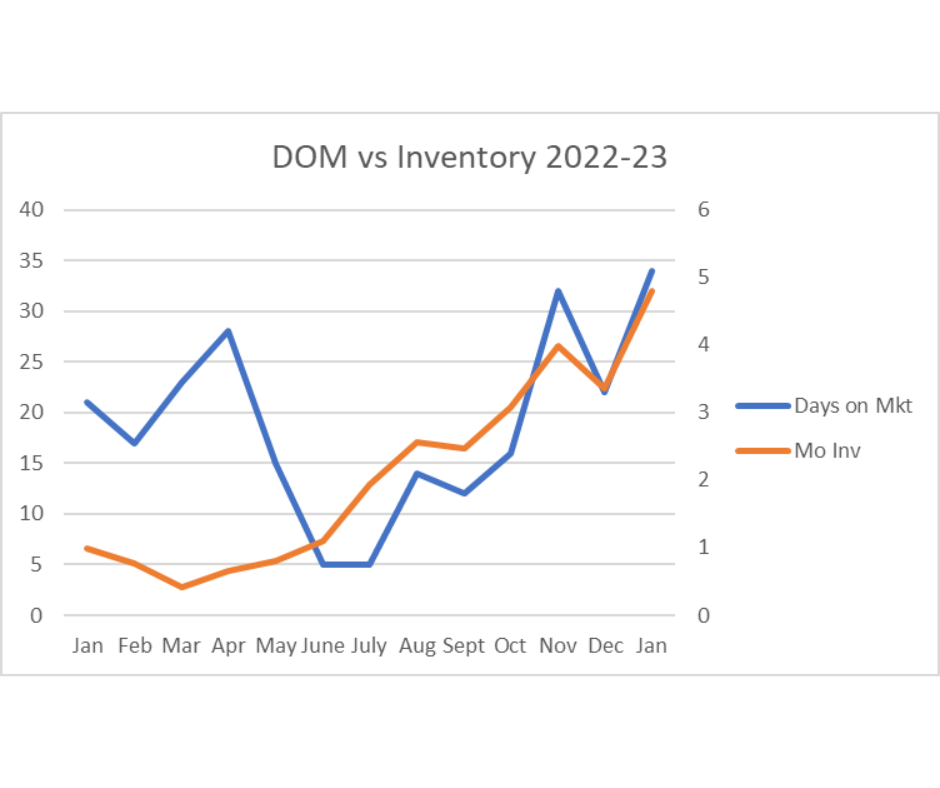

This has resulted in inventory increasing and the days on market following suit. Inventory just reached the 5 month threshold for the first time in about three years. Remember 5-6 months of inventory usually reflects a balanced market.

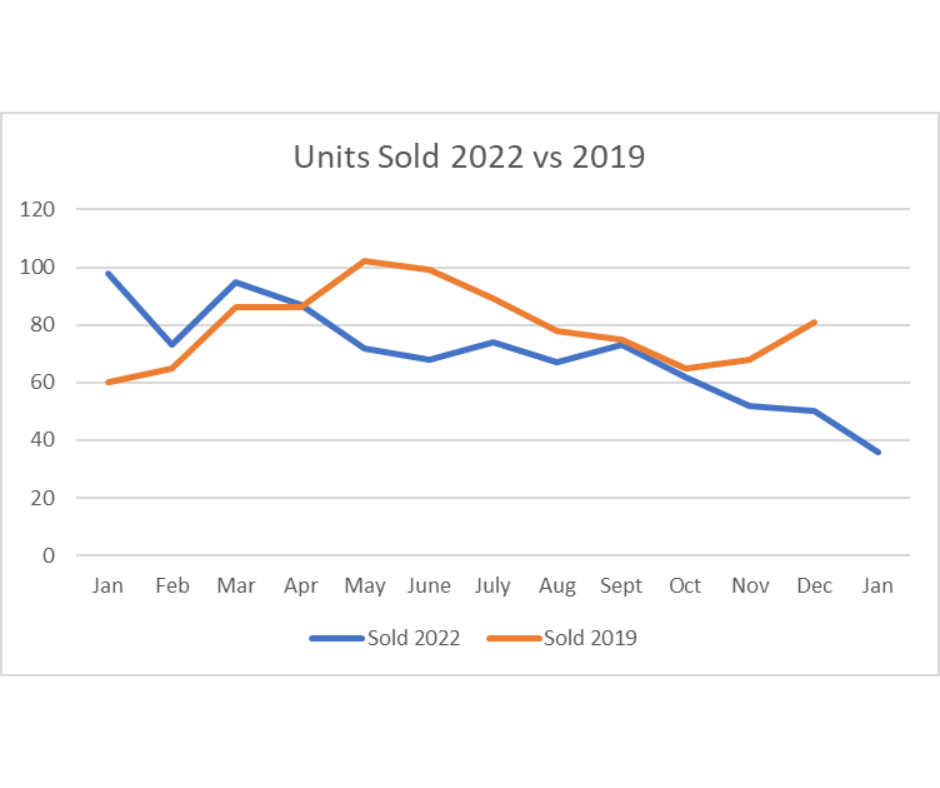

Another major factor in the decreasing sales during this winter is related to the return of seasonality to the market. This chart looks back at 2019, or what might have been considered “normal” activity. The chart reflects that the peak of the market is usually in the summer with a gradual decrease beginning with the new school year. Home sales then historically has a brief bump during the winter holidays and then picks back up in the spring. The summer sales in 2022 were basically flat and have shown a decreasing trend in units sold throughout the winter, which might historically align to some degree taking into consideration the negative pressure on the market.

Looking at the market value during this period reveals one interesting data point. It seems that interest rates at 4-5% had very little impact on home value throughout the summer. However once interest rates went up to 6% the price per square foot started to drop. Banks have recently retracted their rates back to the mid 5% to low 6% range and the price per square foot jumped up a bit. I think that this is also reflective of more investment sales happening in mid fall and more residential homes selling in December & January.

I am hopeful that the activity trend will continue to align with historical seasonality and that sales will start to increase again in the early Spring. If interest rates continue to stabilize at this level, I believe that values will continue at this level as well. Lastly, if inventory and new listings continue at their current levels, we should not experience the ultra-competitive and inflationary markets that we have seen over the last two years.

If you have any questions about this data, the real estate market in general or about your home, please reach out to me directly at 813-420-9963!

This is Tom Leber with the Homeward Real Estate Full Sale Team. I look forward to seeing you around the neighborhood.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |