Hey this is Tom Leber your favorite Seminole Heights Realtor. I recently finished compiling the data for the third quarter of real estate sales in the Heights and Central Tampa, and wanted to give you an update.

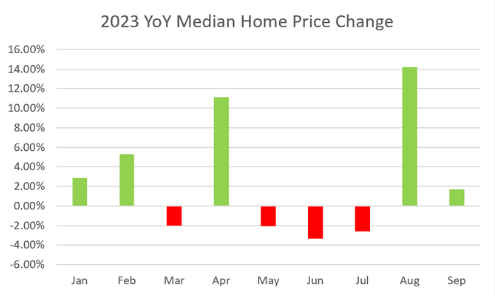

A lot of people ask me how our market is doing and my take is that the news is pretty good!

So is there a general indication of the market going down?

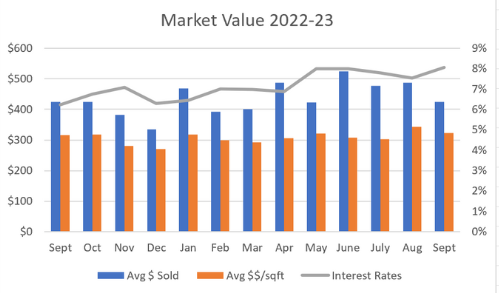

Many of my clients have asked how the interest rates are affecting home sales in the community.

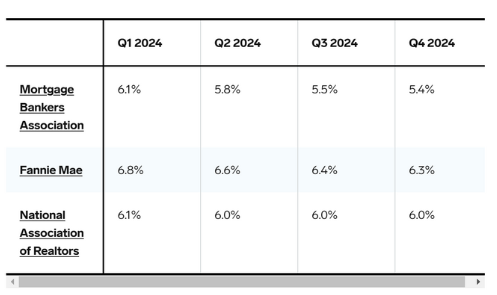

So when will rates go back to 3%?

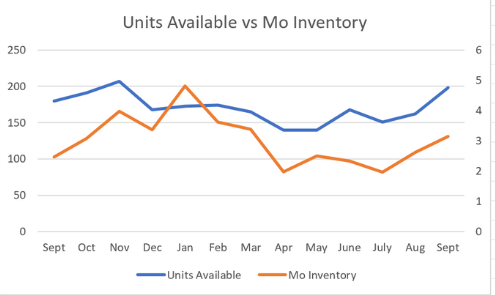

So what does this mean if you are looking to purchase a home soon? There are currently more houses to choose from than in the last couple of years. And while the monthly cost of higher interest rates are a reality today, there are ways to defray these costs until the market can adjust. And all the experts indicate that there’s a bit of light at the end of the tunnel in 2024.

If you are a homeowner, the good news is that the equity that you have realized over the past few years will continue to be stable and continue to grow at a reasonable rate. Homes are currently selling for selling for approximately 95.2% of the price that they are listed on the market.

If you are interested in seeing housing statistics for your specific neighborhood, one of the only places you can find them are in the neighborhood section of my website at SeminoleHeightsLiving.com!

If you are looking to buy or sell a home in the near future, let’s get together and have a conversation about how the market will impact your objectives. Just DM me or comment below and we can set up an opportunity to chat!

SEARCH THE MLS

5001 N Nebraska

Tampa, FL 33603

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |